Taxes are a challenge to defend even in a country where the benefits of our health, education, and social services have created healthy, smart, and contributing residents who make our nation one of the most desirable in the world.

Tony Keller, editorial writer for the Globe and Mail and 2016 National Newspaper Award winner, observes that we have met the enemy of the carbon tax, and it is us.

If the carbon tax were axed, the funding for carbon rebates would disappear, and most Canadians would end up with less money in their pockets, not more. I pointed that out last year, and in the past week it has become the Trudeau government’s key talking point. It has the virtue of being true.

The slogan is short and punchy: “Axe the Tax.”

The words have an obvious appeal for many Canadians: The carbon tax raises prices, so scrapping it would lower prices – and leave people with more money in their pockets.

Right?

That’s the theory behind Conservative Leader Pierre Poilievre’s plan to “bring home lower prices and powerful paycheques” by taking a hatchet to the carbon levy. The claim that axing the carbon tax will leave Canadians financially better off could be a political winner for Mr. Poilievre.

It has just one small defect. It’s not true. (Keller, n.d.)

Tony Keller notes that alternatives to the carbon tax would do the opposite of putting money in people’s pockets.

Take Quebec’s cap-and-trade carbon pricing system. Opacity is its political superpower. Most Quebeckers don’t know that they’re paying, and the money stays in provincial coffers instead of being rebated. A little ignorance buys a lot of political bliss. The cost of cap-and-trade has been a non-issue in Quebec politics.

Or take U.S. President Joe Biden’s Inflation Reduction Act. It has all kinds of programs to reduce emissions, without a consumer carbon tax. How do you get what looks like all benefits and no costs? Run a bigger deficit.

Between 2020 and 2039, Ontario plans to spend $118.1-billion on electricity subsidies, according to the province’s Fiscal Accountability Office. In 2022-2023 alone, Ontario spent $6.8-billion lowering the price of electricity below its cost. How did Premier Doug Ford’s government pay for that? With a budget deficit. Absent the subsidies, Ontario would have run a surplus. (Keller, n.d.)

Trevor Tombe, economics professor and Jennifer Winter, economics and public policy professor at the University of Calgary write that in fact, Canada’s carbon pricing rebates ease affordability pressures for most households. This article was originally published by Policy Options.

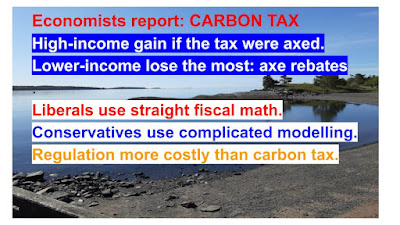

High-income households stand to gain the most if the tax were axed. Lower-income folks who are enjoying more in rebates than carbon-tax costs, meanwhile, stand to lose the most — both in absolute dollars and, especially, as a proportion of their total income.

Liberal government points to the part of the PBO report that features straight fiscal math — how much average households pay minus how much they get back in rebates.

Conservatives point to a part of the PBO report based on complicated modelling that predicts the economic impact of carbon pricing across the economy on things like wages and investment income. By that measure, the PBO says, most households are out of pocket.

Regulation is more costly than carbon pricing, carbon pricing is generally thought of as the most efficient option, the one that's going to cause the least amount of drag on the economy," (Tombe & Winter, 2024)

Larry Hughes, professor in the Department of Electrical and Computer Engineering at Dalhousie University, offers a commentary on Carbon pricing in Atlantic Canada in the Halifax Examiner.

To understand the impact of removing the carbon tax on heating oil, we examined three building types and sizes of home in each province in Atlantic Canada. The building types and sizes, and the number of people living in them (the household size) are:

Apartment 1,000 ft2 Two persons

Single-detached 1,500 ft2 Three persons

Single-attached 2,000 ft2 Four persons

The total carbon tax is calculated using the value of the household’s rebate (CAIP), determined from the number of occupants and using the provincial data. The “balance” is the difference between the household’s CAIP and its total carbon tax.

When the heating oil tax is included, the hypothetical households in Nova Scotia (Figure 5) have a negative balance. With the tax removed, the households all have balances over $300. (Hughes, n.d.)

Robson Fletcher of CBC News reports on the analysis of Canadian carbon tax done by University of Calgary economist Trevor Tombe. He extracted data from the latest version of the SPSD/M, specialized software created and maintained by Statistics Canada, and shared it with CBC News to illustrate how a hypothetical axing of the federal carbon tax would affect different households.

As it stands, there is some minor variation from province to province, but Tombe says the general trend is the same: "A clear majority of households do receive rebates that are larger than the carbon taxes they pay for."

One thing that sets households apart, however, is their income level.

"If we got rid of the carbon tax and the rebate," Tombe said, "then this would harm a much larger fraction of lower- and middle-income households than it would higher-income households." (Fletcher, 2023)

The professional analysis of the effect of taxes done by award winning journalists, and Canadian professors of economics and engineering need to be given significant weight in our assessment of political claims especially in the advent of a federal election.

References

Fletcher, R. (2023, November 8). If Canada axed its carbon tax — and rebates — this is how different households would gain or lose. CBC. Retrieved December 5, 2023, from https://www.cbc.ca/news/canada/calgary/axe-the-tax-and-carbon-rebate-how-canada-households-affected-1.7046905

Hughes, L. (n.d.). Carbon Pricing in Atlantic Canada. Wikipedia. Retrieved March 22, 2024, from https://www.halifaxexaminer.ca/commentary/carbon-pricing-in-atlantic-canada/

Keller, T. (n.d.). We have met the enemy of the carbon tax, and it is us. Globe and Mail. Retrieved March 22, 2024, from https://www.theglobeandmail.com/business/commentary/article-we-have-met-the-enemy-of-the-carbon-tax-and-it-is-us/?login=true

Tombe, T., & Winter, J. (2024, January 1). Don’t Blame Carbon Pricing for Affordability Challenges. The Tyee. Retrieved March 22, 2024, from https://thetyee.ca/Analysis/2024/01/01/Carbon-Pricing-Affordability/

No comments:

Post a Comment